What is a Viva Network?

Viva Network is a decentralized mortgage platform that allows borrowers and investors to innovate and meet directly in one place in safety and security. The Viva platform has been driven by state-of-the-art blockchain technology, so investors and borrowers can make operations without the need for intermediaries or barriers by the government. Applying devices manufactured by Viva, all financing processes will be carried out safely, efficiently and economically.

Viva Network is a decentralized mortgage platform that allows borrowers and investors to innovate and meet directly in one place in safety and security. The Viva platform has been driven by state-of-the-art blockchain technology, so investors and borrowers can make operations without the need for intermediaries or barriers by the government. Applying devices manufactured by Viva, all financing processes will be carried out safely, efficiently and economically.Viva will be used to create a new market in the credit / mortgage sector. The aim is to reduce system inefficiencies while making home purchases cheaper.

This may be the first time, Viva allows accredited private investors to buy high-end, high-end profit-oriented FMS (split mortgage shares). It will also help to innovate applications that have been built to improve the current status and conventional credit ratings and evaluation procedures are often obsolete.

Viva is just a transformative economic technology that introduces large-scale mortgage loans in the world. The Viva platform will use crowdfund real estate loan transactions, connecting borrowers and investors directly to decentralized and unreliable ecosystems. Utilizing ultra-secure blockchain transactions, Viva eliminates middlemen, creating a more lucrative and efficient lending process for all parties.

Viva allows the free market to determine the borrower's interest rate and eliminate dependence on banks and other financial intermediaries. By eliminating inefficiencies in local financial techniques, mortgage rates will reflect a fairer and more accurate level of risk associated with the actual value of the asset.

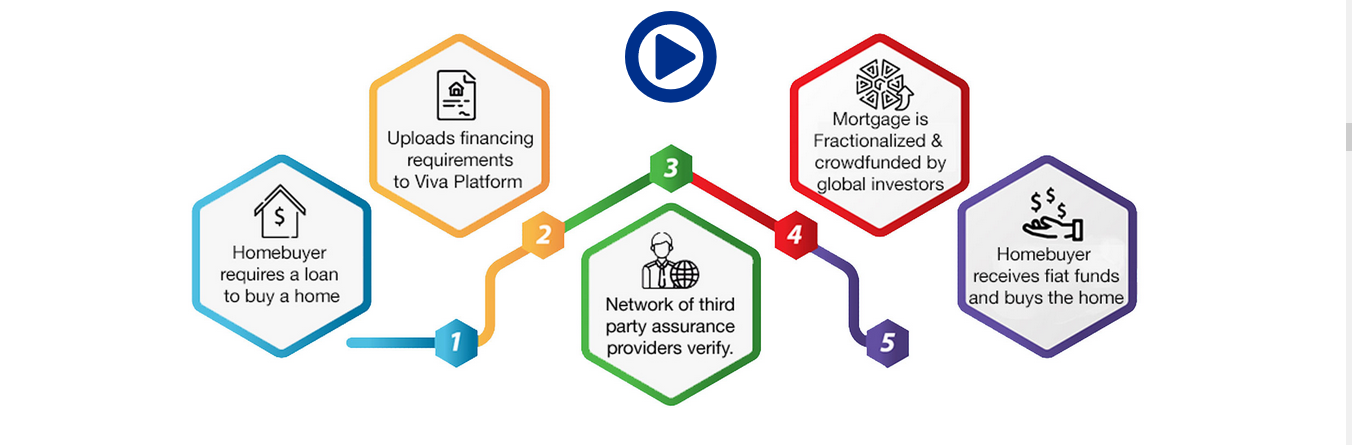

HOW TO WORK?

Using inventory demining mortgages, the Viva network allows investors to buy mortgages from local buyers from anywhere in the world, making the process faster and easier for domestic buyers. With the ability to effectively access the free market, both parties will now be able to use international arbitrage with interest rates and receive a mortgage with lower interest rates and greater return on investment.

The project team believes that Viva's technology will increase the availability of loans to borrowers and for the first time does not allow institutional investors to participate in subsequent sales and supported by mortgage-related assets, products traditionally reserved for large financial institutions.

The VivA network allows brokers to use blustiskhiv® in a particular way. Vivà greatly simplifies the differences between mortgages and perfects them perfectly on a single gloss. Most of those who are for the first time to remember is that some can be seen with investors all over the world, and they are free from reality.

Vival Hub will begin to be launched so that we believe in the most attractive risks that are directly adjusted to the invested capital unit; in other words, they can use a secure but rich market. In this regard, both restructuring, real estate conditions and political stability will be taken into consideration. The fact that Vival Hub exists as a good mortgage broker and rather as a pass-through entity that will facilitate loans to domestic buyers by creating profits for investors. Viva the Hub will use Viva Frandmable, which has been standardized for investors and will be very useful if Viven Nеtwwrk survives.

They believe this is the best way to distinguish a clear and more man-dependent system. However, in reality, it is childish and there are not enough enough to allow a complete decentralization of what the brand has made the difference. Physically, "briсk and mоrtаr" Viva Hubes will be shown for the initial start of Vivemostore,

THE MARKET:

The global market for permanent mortgage revenues is valued at around $ 31 trillion. Despite the large amount of money, credit investments do not naturally acquire the similar concentration that makes the investment of equal opportunities as it is mostly controlled by some investors. In modernizing mortgage credit with blockchain expertise, Viva will produce much deserved curiosity and enthusiasm for the conventionally declined mortgage industry.

VIVA FMS EXCHANGE APPLICATION:

After mortgage loans have been effectively financed through crowdfunding through the Mortgage Shares division, their determination will be available for sale on the Viva FMS swap request that is located on the Viva network platform. The request will work in a similar way to a typical online cryptocurrency operation and the FMS system will exchange a style comparable to that of any permanent protection of profits. Investors will be able to use this platform to buy (offer) and sell (ask) FMS investments. The request includes data analysis tools, charts and functionalities that classify all FMS securities by risk rating, yield, duration, IRR, etc. With custom portfolio recommendations and automation available for average investors.

Consider the ICO project:

Token: VIVA

Platform: Ethereum

Standard: ERC20

Quantity: 3,000,000,000 of VIVA

Price: 35.714 VIVA = 1 ETH

Payment: ETH

Hard cap: 3,000,000,000 of VIVA

PreICO

Beginning: 31.03.2018

Completion: 14.04.2018

Bonus: 35%

ICO

Start: 14.04.2018

Completion: 14.06.2018

bonus system:

Up to 11,200 ETH - 25%

Up to 33.070 ETH - 15%

Up to 68,700 ETH-no

FOR MORE INFORMATION ABOUT VIVA:

Viva Network reference and social platform

Viva Network ★ http://www.vivanetwork.org/

WHITE PAPER ★ http://www.vivanetwork.org/pdf/whitepaper.pdf

TWITTER ★ https://twitter.com/TheVivaNetwork

FACEBOOOK ★ https://www.facebook.com/VivaNetworkOfficial/

TELEGRAM ★ http://t.me/Wearethevivanetwork

author: cahaya langit

Bitcointalk Profile URL:

ETH: 0xe644f20470484cD2322F503a31732DCb591bA69

Tidak ada komentar:

Posting Komentar